Traditional Financing Methods to Access Home Equity

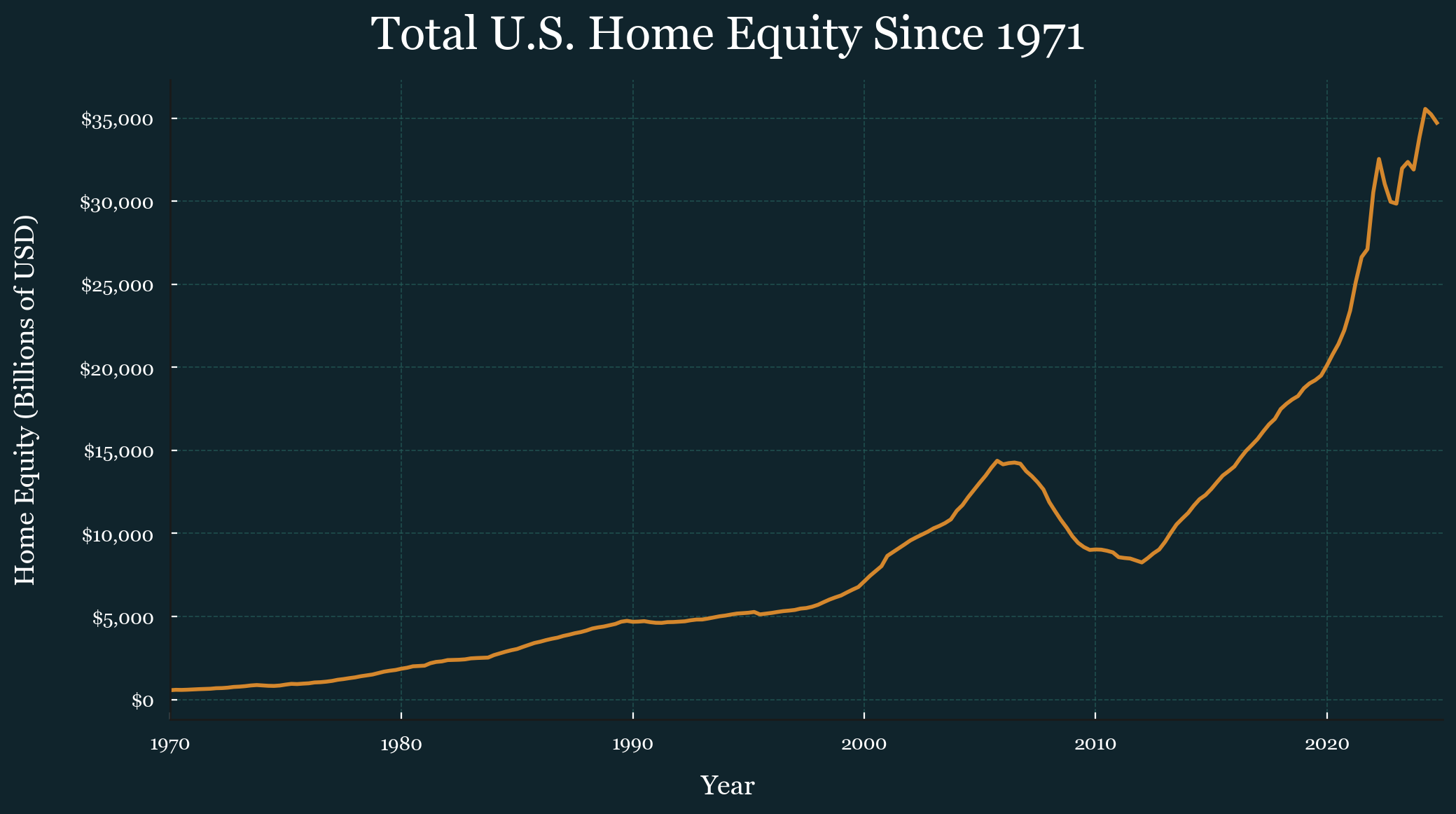

U.S. homeowners currently sit on unprecedented levels of home equity, collectively controlling approximately $35 trillion—more than double the amount recorded before the 2008 financial crisis.

Tapping into home equity remains challenging for many homeowners due to historically low, locked-in mortgage interest rates. Refinancing through traditional methods, such as cash-out refinancing, often means sacrificing these low rates. Nevertheless, there is growing demand among homeowners seeking to access their substantial equity.

Homeowners seeking to access their home equity have several options today:

Selling the Home

- Financial Impact: Eliminates existing mortgage; provides 100% cash proceeds.

- Eligibility and Underwriting: None.

- Key Considerations: Requires relocation and involves transaction costs.

Cash-Out Refinance

- Financial Impact: New mortgage replaces old; excess cash provided.

- Eligibility and Underwriting: Requires good credit and stable income.

- Key Considerations: Entire mortgage refinanced, meaning low locked-in interest rates will not remain; involves closing costs.

Home Equity Line of Credit (HELOC)

- Financial Impact: Revolving credit line accessed as needed.

- Eligibility and Underwriting: Strong credit and sufficient home equity (typically max ~85% LTV).

- Key Considerations: Variable rates can significantly increase payments.

Home Equity Investment (HEI)

- Financial Impact: Immediate lump sum provided without monthly repayments.

- Eligibility and Underwriting: Credit score, property condition, and combined LTV ≤75%.

- Key Considerations: Must eventually settle through buyout or sale.

Reverse Mortgage

- Financial Impact: Regular payments or credit line; no monthly repayments required.

- Eligibility and Underwriting: Homeowner aged 62 or older with sufficient home equity.

- Key Considerations: Requires maintaining property, taxes, and insurance.

HELOCs and HEIs have grown in popularity but primarily cater to customers with immediate cash needs or efficient debt consolidation. These methods typically do not focus on enabling customers to diversify their home equity.

This is where Horizon stands apart. Our unique solution allows you to efficiently diversify your home equity into Bitcoin. We partner with providers utilizing the same robust legal framework as HEIs but tailor the terms specifically toward wealth diversification, offering homeowners a distinct pathway to enhancing their financial futures.

Disclaimer: Horizon is a technology company that helps users buy and custody their Bitcoin and does not directly provide financial or investment services. Horizon connects homeowners with licensed home equity investment providers but does not act as an agent or broker for the homeowner or any third party. Homeowners should consult their financial, tax, or legal advisor before making any investment decision.