How Horizon Works and Why It’s Built for Bitcoiners

Most homeowners have been told there are only a few ways to access their home equity: a loan, a HELOC, or a reverse mortgage.

Horizon is none of those.

We built Horizon to serve a different purpose entirely. It is designed to help long-term bitcoin holders unlock their home equity without selling their house and without taking on more debt.

If you are a homeowner who believes in Bitcoin's long-term outperformance, Horizon was built for you.

Let’s walk through how it works, what it costs, the risks involved, and most importantly, what you get to keep.

What Horizon Isn’t

There are a lot of misconceptions around home equity financing, so let’s get those out of the way first. What our solution isn’t

It’s not a HELOC. There are no monthly payments. There is no interest rate. There is no fixed loan term. You are not taking on a revolving credit line or facing a balloon repayment schedule.

It’s not a loan. You are not borrowing money. There is no repayment amount based on principal and interest. Instead, our preferred provider shares in the future appreciation or depreciation of your home.

It’s not a reverse mortgage. There are no age requirements. You retain full ownership of your home. And unlike reverse mortgages, Horizon does not accrue debt over time.

Instead, we help you sell a share of your home’s future value in exchange for tax-free upfront cash today.

You can use that cash however you want, including to buy and hold more Bitcoin.

There are no interest charges. No recurring payments. No change in your home ownership. Just equity unlocked on your terms.

Horizon was built with one mission: to help long-term bitcoin holders access the wealth tied up in their homes without touching their cash reserves or selling assets they want to keep.

How Horizon Works

Let’s walk through a simple example.

You own a home valued at $1 million. Over time, you’ve built up substantial equity, and you want to access a portion of it to buy Bitcoin.

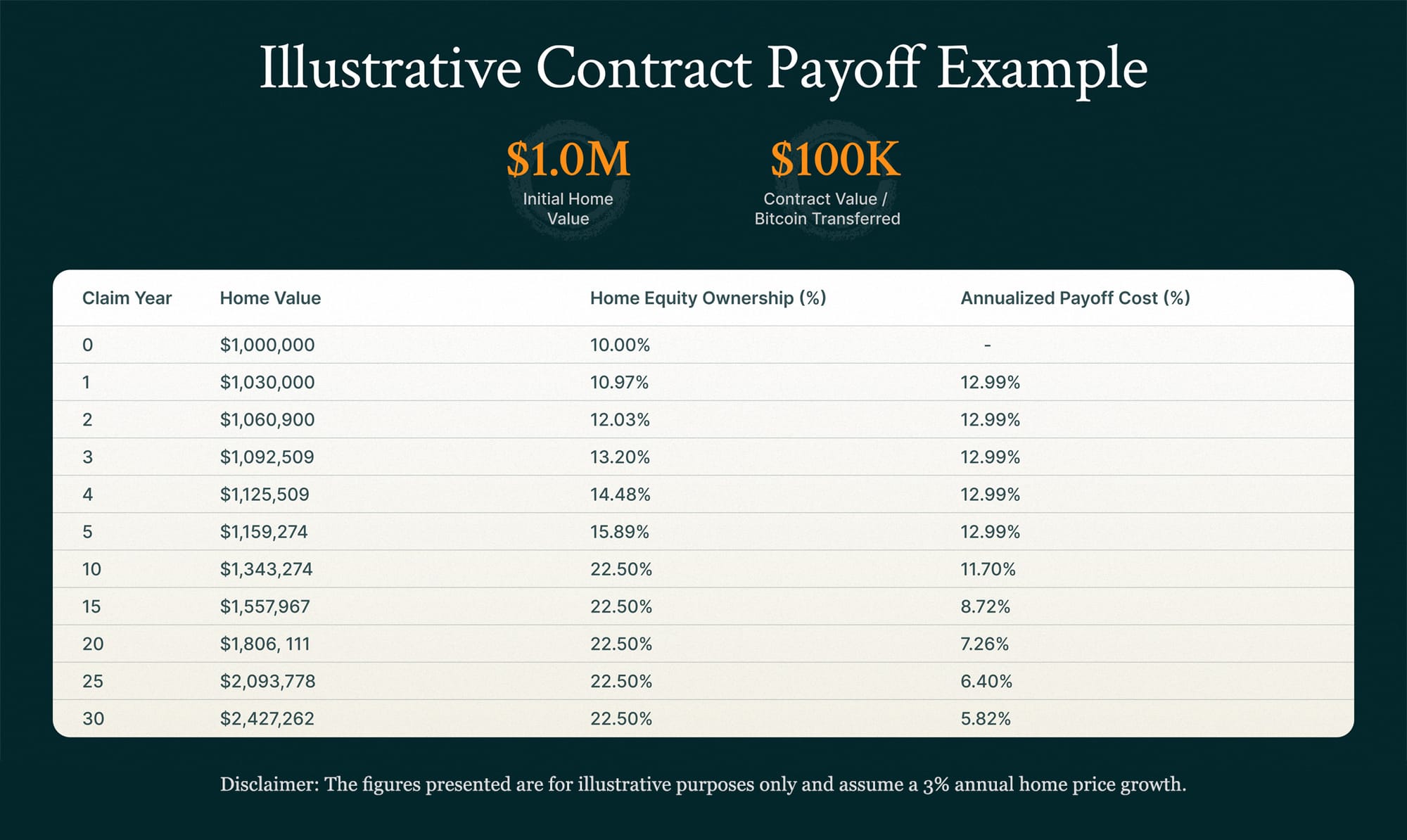

With Horizon, you unlock $100,000 in cash. This represents 10 percent of your home’s current value. That amount may vary depending on your home, your equity, and the terms offered by Horizon’s preferred provider.

In return, the provider receives a small ownership interest in your home’s future value. That interest starts at 10 percent and gradually increases over time, capped at a maximum of 22.5 percent, which is equivalent to 2.25 times your initial investment. This cap is subject to change in the future based on the terms set by our preferred provider.

The pace of this growth depends on your home’s appreciation, which in our model is assumed at 3 percent per year. This is based on long-term U.S. housing trends. As your home value rises, the provider’s share becomes more valuable, but it can never exceed the cap.

Here is what that looks like in practice:

- In year 1, your home is worth $1.03 million. The provider’s share grows slightly to 10.97 percent. Your effective cost is 12.99 percent annualized. That is the ceiling. No matter how your home performs, it will never cost you more than that.

- In year 5, your home is worth approximately $1.16 million. The provider’s share is now 15.89 percent. Your annualized cost remains 12.99 percent.

- By year 10, the share reaches the 22.5 percent cap. From this point on, the cost begins to decline. Your effective annual cost drops to 11.7 percent.

- In year 20, the cost falls to 7.26 percent.

- By year 30, it drops even further to just 5.82 percent annualized.

The longer you hold, the lower your cost becomes.

This structure rewards patience. Unlike loans or credit lines that accumulate interest or demand payment on a fixed schedule, Horizon’s model aligns with long-term thinking. If you are planning to stay in your home for many years, the economics improve over time.

Let’s not forget what you used that unlocked $100,000 for: you bought Bitcoin.

If you believe that bitcoin will continue to outperform home appreciation over time, then Horizon offers a way to put your equity to work. You are not required to sell your home. You are not giving up ownership. You are not making monthly payments or owing interest.

There is no fixed deadline. You settle the agreement when you choose to move, refinance, or repurchase the provider’s share of your home.

You remain the homeowner, and you stay in control.

What Happens to the Acquired Bitcoin?

This is one of the most important questions for Bitcoiners considering Horizon: what happens to the Bitcoin you buy with the unlocked equity?

The answer is simple: the Bitcoin you purchase is entirely yours.

Horizon does not hold your bitcoin under any circumstances. It is never used as collateral, and Horizon has no claim on it. We do not participate in any upside from its appreciation.

Once you receive the cash from unlocking your home equity, you are free to use it however you choose. If you decide to purchase bitcoin, you retain full control over how it is stored. Whether you opt for self-custody, a multisig wallet, cold storage, or a secure transfer to another account, Horizon has no involvement.

The only asset our preferred provider has a stake in is a portion of your home’s future value. Your Bitcoin remains separate and secure, outside the structure of the equity agreement.

This is not a loan secured by your bitcoin. There are no margin calls, no liquidation risk, and no scenario in which your Bitcoin can be seized or forfeited.

If your goal is to hold Bitcoin over the long term, Horizon simply helps you unlock the capital to make that possible, without compromising your custody or exposure.

You maintain full ownership of both your home and your Bitcoin.

What Are the Risks?

Like any financial decision, using Horizon comes with trade-offs. Transparency is core to how we operate, and it is important to understand what those trade-offs are.

The most direct cost of using Horizon is giving up a portion of your home’s future value. In exchange for the upfront capital, the provider receives a gradually increasing stake in your home’s appreciated value, up to a capped maximum.

One common concern is what happens if your home decreases in value.

The answer is that the provider shares in the downside. There is no fixed repayment amount. If the market value of your home falls, the value of the provider’s share decreases as well.

Another question we often hear is what if you want to exit early.

Horizon allows for flexibility. You can exit the agreement at any time by buying out the provider’s stake based on your home’s fair market value and any adjustments. You are never locked in for the full term if your plans change.

Some users also ask about the risk of using the unlocked capital to purchase Bitcoin. What if the price of Bitcoin drops after you invest?

This is a decision that rests with you. Horizon does not control or influence your investment choices. Your bitcoin holdings are not tied to the performance of your home. If Bitcoin’s price declines, there are no liquidations, no interest penalties, and no risk of foreclosure.

In every case, Horizon is structured to give you optionality without tying that flexibility to debt, interest, or complex repayment schedules.

It is about giving you control over your wealth, in a structure that supports long-term thinking.

Why Bitcoiners Use Horizon

If you believe that Bitcoin will continue to outperform real estate over the long term, Horizon is a way to act on that conviction.

Many Bitcoiners view Horizon as an asymmetric trade. It allows you to convert part of your home equity, often the largest and most illiquid asset in your portfolio, into Bitcoin, which is scarce, portable, and historically higher performing.

Instead of watching Bitcoin rise while your equity sits idle, Horizon gives you a path to reallocate. You can unlock capital from your home without selling it, without taking on new debt, and without making monthly payments.

Because Horizon does not share in the appreciation of your Bitcoin, all of the upside belongs to you.

Here is how it works in practice:

- You unlock $100,000 in equity

- You use those funds to buy bitcoin

- You hold your bitcoin over time

- You settle the home equity agreement when you sell, refinance, or choose to repurchase the provider’s share

As long as Bitcoin continues to outperform your home’s appreciation, the value you gain from holding Bitcoin can exceed the cost of the home equity agreement.

This strategy may appeal to homeowners who already believe in bitcoin’s long-term thesis and who are looking for a way to increase their holdings without altering their lifestyle or selling existing assets.

Horizon allows you to do exactly that. You maintain control of your home, keep 100% of your Bitcoin, and gain access to capital that would otherwise remain locked.

What It Costs and How It Compares

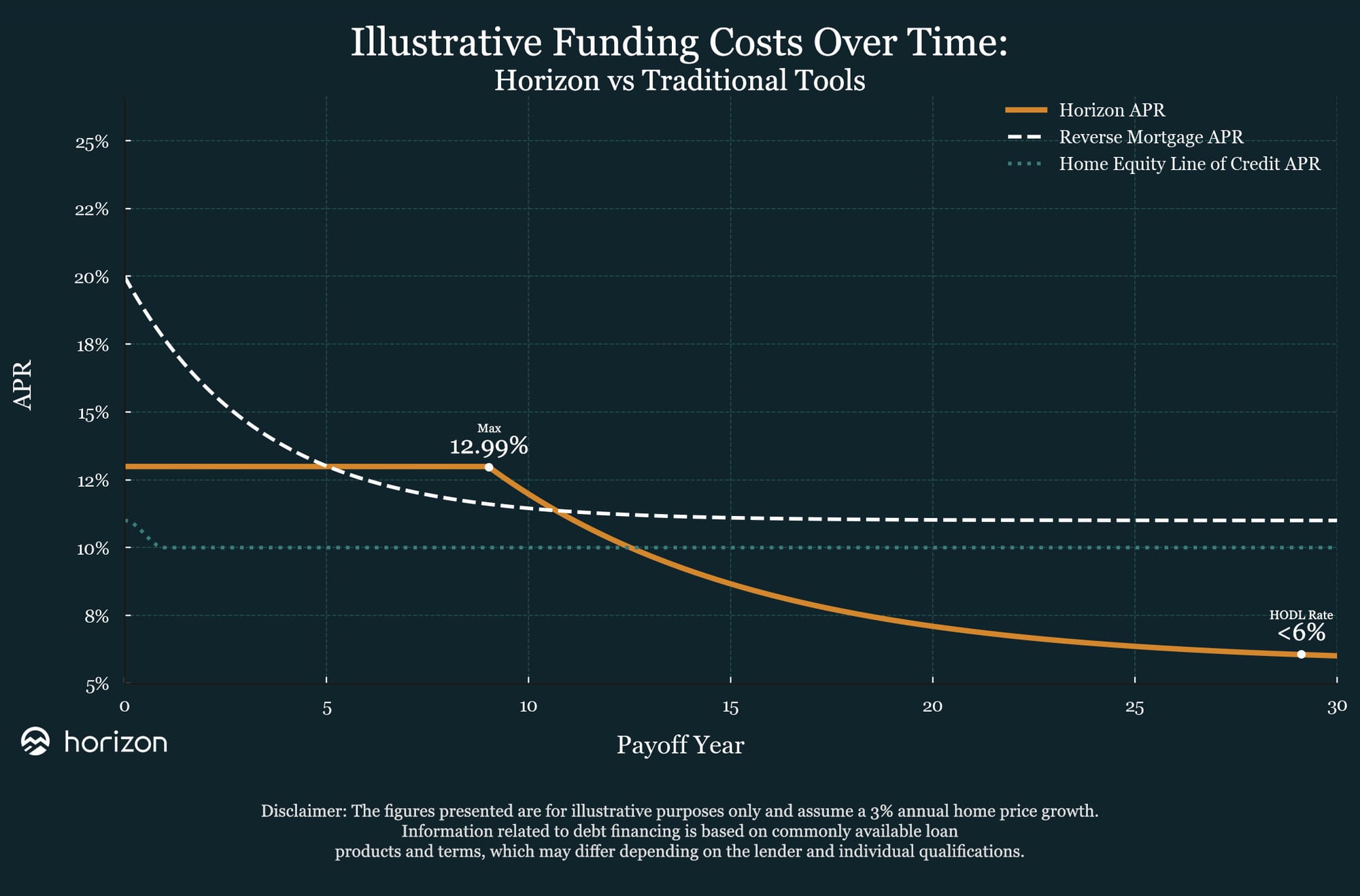

Let’s take a closer look at how Horizon’s payoff cost is structured and how it compares to other common home equity financing options.

With Horizon, there is a built-in protection: the cost is capped. No matter how quickly your home appreciates, your effective annualized cost will never exceed 12.99%.

Over time, that cost declines. The longer you hold the agreement, the more favorable it becomes. After 30 years, your effective annual cost can fall below 6 percent. This is what we refer to as your long-term holding rate.

To understand how this compares to traditional options, consider a typical reverse mortgage or a home equity line of credit (HELOC).

Reverse mortgages often start with lower rates, but their costs increase over time through accrued interest. HELOCs may appear affordable in early years, but their variable interest rates can rise sharply, especially in a higher rate environment.

By contrast, Horizon offers a declining cost structure that benefits long-term thinkers. For homeowners with a bitcoin mindset and a low time preference, this model aligns with how you already think about capital.

You access equity on your terms. You maintain flexibility. And over time, you are rewarded for your patience.

Horizon is not just another home equity product. It is a new way to reallocate your wealth into the asset you believe in most, with a cost structure that gets better the longer you hold.

If you have substantial equity in your home, believe in Bitcoin’s long-term growth, and want to increase your exposure without disrupting your lifestyle, Horizon was built for you.

You are not taking out a loan. There is no interest accumulating over time. There are no additional monthly payments. There is no payment required from your Bitcoin’s upside.

Instead, you get a smarter way to access the capital already locked in your home and put it to work in an asset with global demand and finite supply.

You can use Horizon’s calculator to explore what this could look like for your situation. Every homeowner’s scenario is unique.

At Horizon, our mission is simple. We help homeowners unlock equity so they can secure their financial future with Bitcoin.

Disclaimer: Horizon is a technology company that helps users buy and custody their Bitcoin and does not directly provide financial or investment services. Horizon connects homeowners with licensed home equity investment providers but does not act as an agent or broker for the homeowner or any third party. Homeowners should consult their financial, tax, or legal advisor before making any investment decision. For additional information, please refer to our FAQ, terms and conditions, and our preferred providers' websites.