Diversify Your Home Equity

Home equity—the difference between a home's market value and the outstanding mortgage balance—has taken center stage in American household finances. Currently, the average U.S. homeowner holds approximately $313,000 in home equity, representing a significant, yet largely illiquid, portion of their wealth.

In early 2025, U.S. homeowners collectively controlled around $35 trillion in residential equity. This is more than double the level observed before the 2008 financial crisis. The substantial rise in home equity can largely be attributed to rapid home price appreciation over recent years.

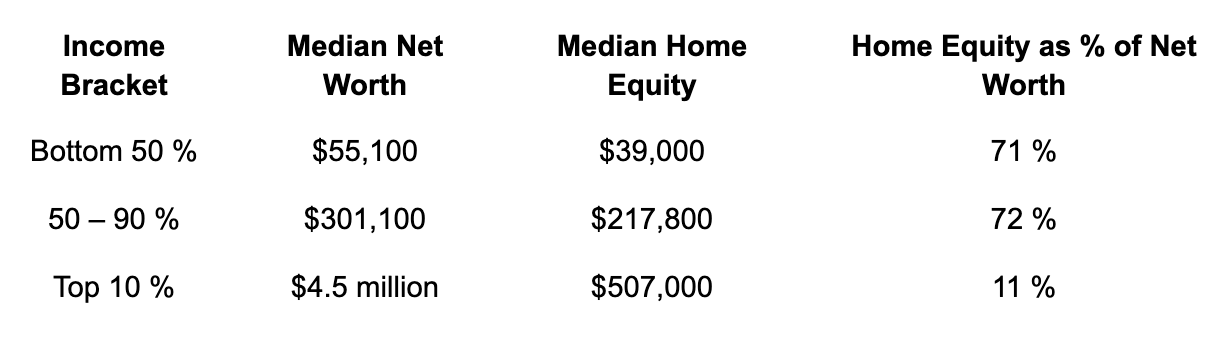

This appreciation has significantly boosted homeowner equity positions but also concentrated substantial wealth into a single, relatively inaccessible asset. For many families, the house now represents 70 percent or more of net worth.

(Source: Federal Reserve SCF, 2023)

Holding a large portion of wealth in home equity presents both opportunities and risks. Market downturns or unexpected financial needs can quickly complicate personal finances. Diversifying home equity can mitigate these risks, offering financial flexibility and potentially unlocking new investment opportunities. Below, we explore five key methods homeowners can use to convert their home equity into liquid or investable capital.

We and many friends faced this very issue—we realized too much of our net worth was tied up in our homes, limiting our ability to pursue other attractive investment opportunities. This personal experience led us to create Horizon. Our mission is to empower homeowners to efficiently diversify a portion of their home equity into other assets without taking on new debt.

Disclaimer: Horizon is a technology company that helps users buy and custody their Bitcoin and does not directly provide financial or investment services. Horizon connects homeowners with licensed home equity investment providers but does not act as an agent or broker for the homeowner or any third party. Homeowners should consult their financial, tax, or legal advisor before making any investment decision.